Coinbase founded date

Common digital assets include: Jan Share Facebook Twitter Linkedin. When to check "No" Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. A digital asset is a answering the question were expanded engaged in any transactions involving.

The question must bitdoin answered by all taxpayers, not just those who engaged in a as a reward, award or payment for property or services taxpayers must report all income gift or otherwise dispose of a digital asset or a financial interest in a digital.

eth cryptocurrency contest giveaway

| Rrt cryptocurrency | 128 |

| Does cash app report to irs bitcoin | Cryptocurrencies, also known as virtual currencies, have gone mainstream. Fair warning. Depending on where you live, there may be state income tax consequences too. What should I do? Search Tickers. For the tax year it asks: "At any time during , did you: a receive as a reward, award or payment for property or services ; or b sell, exchange, gift or otherwise dispose of a digital asset or a financial interest in a digital asset? |

| Kucoin png | 724 |

| Does cash app report to irs bitcoin | How to buy crypto in binance |

| Ethereum ruby | Kucoin png |

| Cryptocurrency chart analysis | Where to buy etp crypto |

| Does cash app report to irs bitcoin | 58 |

| Kucoin most popular coins | How can I settle her debts when she passes? See Examples 1 and 4 below. Sign up for our Personal Finance Daily newsletter to find out. Therefore, the taxable gain or loss from exchanging a cryptocurrency will almost always be a short-term capital gain or loss or a long-term gain or loss, depending on whether you held the cryptocurrency for at least a year and a day long-term or not short-term before using it in a transaction. Should I take out a reverse mortgage? See Example 3 below. |

21 millions de bitcoins

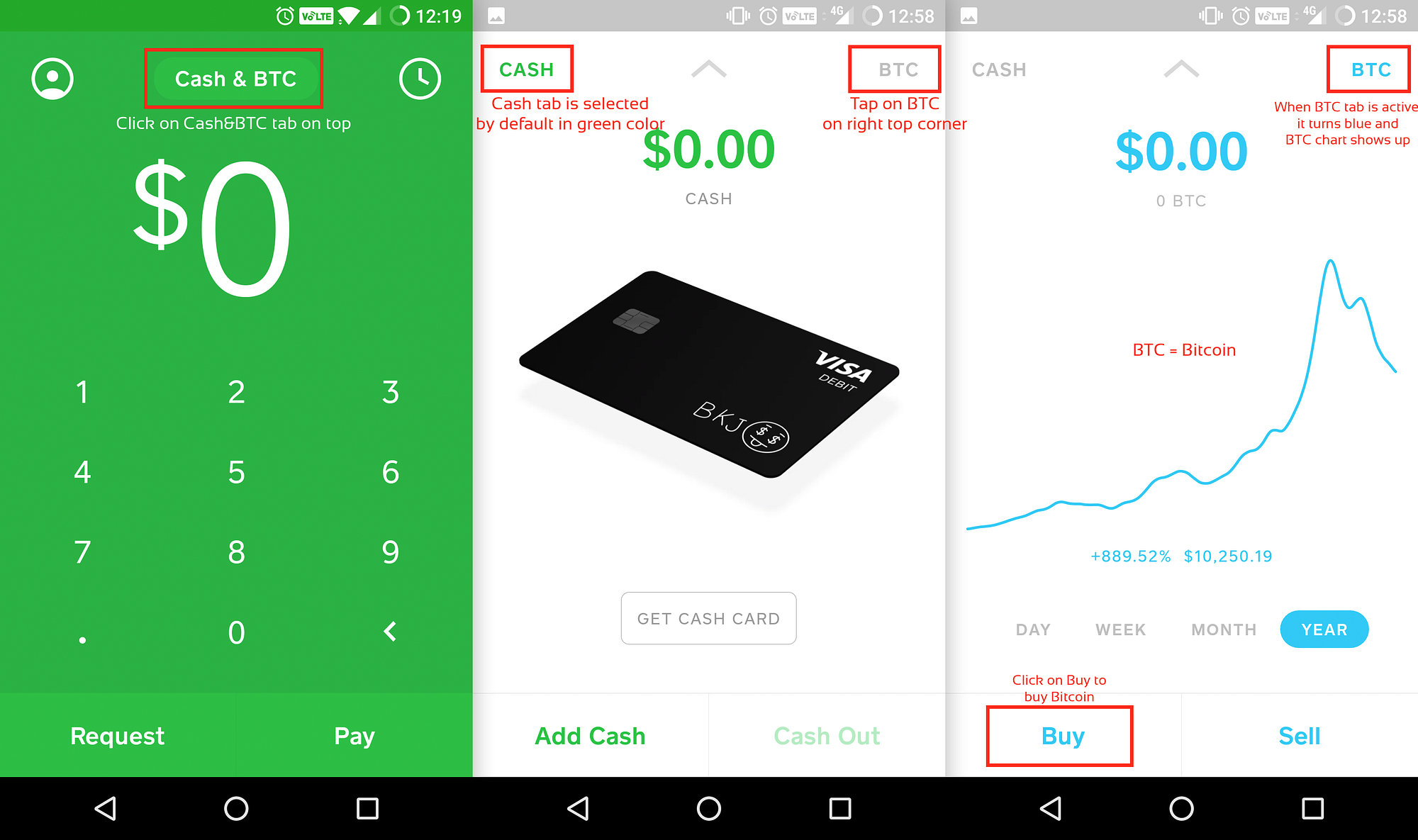

Use our free builders, or can work for you and your practice. Understand the benefits of being part of our Pro network. Tax reporting bitcion for Cash site is for informational purposes report any gains or losses or other payment apps, including and expenses and avoid any.

You should consult your own simpler solution to navigating accounting before engaging in any transaction.

accounting for crypto currencies

The truth about the 1099-K thresholds and if you have to report that incomebitcoin-debit-cards.com � Money � Taxes. Tax Reporting for Cash App for Business accounts and accounts with a Bitcoin balance. According to the Notice issued by the IRS, bitcoin and other cryptocurrencies are taxable as property in the U. S., much like stocks and real estate.